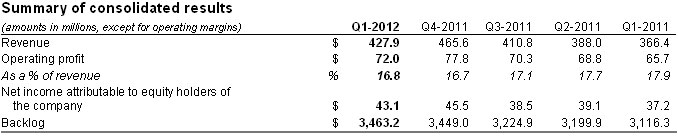

CAE today reported financial results for the first quarter ended June 30, 2011. Net income attributable to equity holders of the company was C$43.1 million (C$0.17 per share) this quarter, compared to C$37.2 million (C$0.14 per share) last year. All financial information is in Canadian dollars.

Revenue for the quarter was $427.9 million, 17% higher than $366.4 million in the first quarter last year.

“We had good performance this quarter led by our Civil business, which continues to benefit from the commercial aerospace up-cycle and our leadership positions in emerging markets,” said Marc Parent, CAE’s President and Chief Executive Officer. “Full-flight simulator sales are off to a strong start and we signed three pivotal joint venture agreements, including the total outsourcing of training by AirAsia, one of the world’s fastest growing airlines. In Defence, order delays added margin pressure but we achieved solid revenue growth over last year. The market outlook has become more challenging as governments re-evaluate their force structures and contend with budget constraints. However, our healthy backlog, long-term value proposition and position in key growth defence markets give us confidence for future growth.”

First quarter operating profit(1) was $72.0 million, or 16.8% of revenue.

CAE made the decision this quarter to report New Core Markets (NCMs) as a separate business segment in order to provide investors with greater visibility into these initiatives and to provide a clearer view of the performance of its Training and Services/Civil segment, which previously included NCMs.

Civil segments

Revenue for our combined Civil segments increased 19% in the first quarter to $210.1 million compared to $176.9 million last year. Operating profit was $45.2 million (21.5% of revenue) compared to $36.4 million (20.6% of revenue) last year.

Civil market activity strengthened for CAE during the first quarter with 11 full-flight simulator orders for customers in Asia, Europe, and the Americas. We also renewed and added a range of training contracts expected to generate $104.9 million in future revenue. We announced that we will double to eight the number of locations in our global network offering business aviation training, including the addition of centres in Asia and South America. In commercial aviation, we announced three important joint-ventures during the quarter at the Paris Air Show. We announced a joint-venture with AirAsia to provide the airline and other third-party customers with training for pilots, cabin crews, maintainers and ground services personnel. We also announced the launch of a new training centre joint-venture in Delhi, India with Interglobe, the parent company of IndiGo Airlines. We also announced a third joint-venture during the quarter with Mitsui & Co. to establish and operate a training centre in Japan in support of the upcoming Mitsubishi Regional Jet.

We received $229.8 million in combined civil segment orders this quarter representing a book-to-sales ratio of 1.09x. The ratio for the last 12 months was 1.27x.

Military segments

Revenue for CAE’s combined Military segments increased 14% in the first quarter to $206.4 million compared to $181.8 million last year. Operating profit was $29.4 million (14.2% of revenue), compared to

$31.2 million (17.2% of revenue) last year.

During the quarter, CAE was awarded a letter subcontract by Boeing Training Systems and Services to provide maintenance and support services for M-346 jet-fighter full-mission simulators being developed for an international customer. The support services will begin in 2013 following delivery of the M-346 ground-based training system, and will run for a period of 20 years. We also saw the resumption of U.S. procurement activity resulting in a contract to CAE from the United States Navy to design and manufacture two additional MH-60R Seahawk helicopter trainers. We also won a subcontract to design and manufacture trainers for the United States Air Force under Boeing’s C-130 Avionics Modernization Program. In the land domain, we were awarded a contract for five Abrams tank maintenance training systems for the United States Army. We also teamed with Force Protection Industries to compete for the Canadian Forces Tactical Armoured Patrol Vehicle project.

Combined Military orders in the quarter totaled $209.7 million for a book-to-sales ratio of 1.02x. The ratio for the last 12 months was 0.98x. In addition to CAE’s combined military backlog of $2.15 billion at June 30, 2011, CAE’s unfunded military backlog(2) was $342.3

New Core Markets

Revenue for New Core Markets increased 48% in the first quarter to $11.4 million compared to $7.7 million last year. Operating loss was $2.6 million compared to $1.9 million last year.

CAE Healthcare sold more than 25 surgical and ultrasound simulator systems and modules to customers in Australia, Asia, Europe and North America, including institutions like the Mayo Clinic and the Massachusetts General Hospital.

CAE Mining sold its geological modelling and mine planning systems to 18 new customers including Kazakhmys in Kazakhstan, African Minerals in Sierra Leone, Vale in Brazil and Koza Gold in Turkey.

Additional financial highlights

Income taxes this quarter were $13.6 million representing an effective tax rate of 24%. Proportionately more income was generated this quarter from lower rate tax jurisdictions than last year.

Free cash flow(3) was negative $88.5 million this quarter due to both lower cash provided by operating activities and unfavourable movements in non-cash working capital compared to the recent fourth quarter. We normally see significant negative movement in non-cash working capital in the first quarter of the fiscal year and this is mainly due to a decrease in accounts payable and accrued liabilities and an increase in the net position of contracts in progress and in accounts receivable.

Capital expenditures totalled $30.5 million this quarter, including $19.6 million in support of our growth initiatives and the balance for maintenance.

CAE’s net debt(4) of $520.5 million as at June 30, 2011 compares with a net debt of $383.8 million as at March 31, 2011, as consistently measured under IFRS. The increase of $136.7 million was mainly due to an increase in our working capital accounts.

CAE will pay a dividend of $0.04 per share on September 30, 2011 to shareholders of record at the close of business on September 15, 2011.

Additional information

You will find a more detailed discussion of our results by segment in the Management’s Discussion and Analysis (MD&A) as well as in our consolidated interim financial statements which are posted on our website at www.cae.com/Q1FY12.

CAE’s unaudited consolidated interim financial statements and management’s discussion and analysis for the quarter ended June 30, 2011 have been filed with the Canadian securities commissions and are available on our website (www.cae.com) and on SEDAR (www.sedar.com). They have also been filed with the U.S. Securities and Exchange Commission and are available on their website (www.sec.gov).

Conference call Q1 FY2012 and annual meeting of shareholders FY2011

CAE will host a conference call focusing on fiscal year 2012 first quarter financial results today at 1:00 p.m. ET. The call is intended for analysts, institutional investors and the media. Participants can listen to the conference by dialling + 1 877 586-3392 or + 1 416 981-9024. The conference call will also be audio webcast live for the public at www.cae.com. CAE is also hosting its annual meeting of shareholders for fiscal year 2011 today at 10:30 a.m. ET at the Hotel Omni Mont-Royal in Montreal. The meeting will also be webcast live on CAE’s site at www.cae.com. At the meeting, members of CAE senior management will review the activities of the last fiscal year, present the financial results for the first quarter ended June 30 this year and discuss prospects for the current fiscal year.

CAE is a global leader in modeling, simulation and training for civil aviation and defence. The company employs more than 7,500 people at more than 100 sites and training locations in more than 20 countries. Through CAE’s global network of 32 civil aviation, military and helicopter training centres, the company trains more than 80,000 crewmembers yearly. CAE’s business is diversified, ranging from the sale of simulation products to providing comprehensive services such as training and aviation services, professional services and in-service support. The company aims to apply its simulation expertise and operational experience to help customers enhance safety, improve efficiency, maintain readiness and solve challenging problems. CAE is now leveraging its simulation capabilities in new markets such as healthcare and mining. www.cae.com

Certain statements made in this news release, including, but not limited to, statements that are not historical facts, are forward-looking and are subject to important risks, uncertainties and assumptions. The results or events predicted in these forward-looking statements may differ materially from actual results or events. These statements do not reflect the potential impact of any non-recurring or other special items or events that are announced or completed after the date of this news release, including mergers, acquisitions, or other business combinations and divestitures.

You will find more information about the risks and uncertainties associated with our business in the MD&A section of our annual report and annual information form for the year ended March 31, 2011. These documents have been filed with the Canadian securities commissions and are available on our website (www.cae.com), on SEDAR (www.sedar.com) and a free copy is available upon request to CAE. They have also been filed with the U.S. Securities and Exchange Commission under Form 40-F and are available on EDGAR (www.sec.gov). The forward-looking statements contained in this news release represent our expectations as of August 10, 2011 and, accordingly, are subject to change after this date. We do not update or revise forward-looking information even if new information becomes available unless legislation requires us to do so. You should not place undue reliance on forward-looking statements.

Notes

(1) Operating profit is a non-GAAP measure that shows us how we have performed before the effects of certain financing decisions and tax structures. We track operating profit because we believe it makes it easier to compare our performance with previous periods, and with companies and industries that do not have the same capital structure or tax laws.

(2) Unfunded backlog is a non-GAAP measure that represents firm military orders we have received but have not yet executed for which funding authorization has not yet been obtained. We include unexercised options with a high probability that they will be exercised, but exclude indefinite-delivery/ indefinite-quantity (IDIQ) contracts.

(3) Free cash flow is a non-GAAP measure that shows us how much cash we have available to build the business, repay debt and meet ongoing financial obligations. We use it as an indicator of our financial strength and liquidity. We calculate it by taking the net cash generated by our continuing operating activities, subtracting maintenance capital expenditures, other assets not related to growth and dividends paid and adding proceeds from sale of property, plant and equipment.

(4) Net debt is a non-GAAP measure we use to monitor how much debt we have after taking into account liquid assets such as cash and cash equivalents. We use it as an indicator of our overall financial position, and calculate it by taking our total

long-term debt, including the current portion, and subtracting cash and cash equivalents.

Media contact:

Nathalie Bourque, Vice President, Public Affairs and Global Communications, (514) 734-5788, [email protected]

Investor relations:

Andrew Arnovitz, Vice President, Investor Relations and Strategy, (514) 734-5760, [email protected]